Stock Market Performance 14-Jan-2025: The Pakistan Stock Exchange (PSX) closed higher on January 14, 2025, with the KSE-100 Index gaining 574.10 points (+0.50%), settling at 114,804.16. After the robust performance on January 13, the market continued its upward momentum, driven by investor optimism and selective buying in key sectors. The index fluctuated between a low of 113,836.60 and a high of 115,044.79, reflecting moderate volatility during the session.

Trading volumes rose significantly to 258.82 million shares, compared to 196.37 million on January 13, signaling increased investor participation. The YTD change improved marginally to -0.28%, while the one-year change stood at 78.63%, further strengthening the positive market sentiment. Gains were observed in energy, cement, and technology sectors, boosting overall confidence.

KSE-100 Index Summary

| Metric | Value | Change |

|---|---|---|

| Closing Value | 114,804.16 | +574.10 (+0.50%) |

| Day Range | 113,836.60 – 115,044.79 | |

| Volume | 258,818,915 | +62,446,505 |

| 1-Year Change | +78.63% | |

| YTD Change | -0.28% | +0.31% |

| 52-Week Range | 59,191.86 – 118,735.10 |

Top Active Stocks

Investor activity was concentrated in high-volume stocks, with energy and financial sectors leading the charge. Cnergyico PK (CNERGY) remained the most traded stock, witnessing strong buying interest, while PRL and K-Electric (KEL) also attracted significant volumes.

Check out the Next Day Performance: 15-Jan-2025

The overall performance of active stocks reflects growing interest in undervalued scrips, as investors looked to capitalize on potential upside in the short term. Increased activity in SSGC and HASCOL further highlighted the positive outlook in energy-related stocks.

| Symbol | Price | Change | Volume |

|---|---|---|---|

| CNERGY | 7.21 | +0.26 (3.74%) | 42,527,928 |

| PRL | 41.50 | +2.74 (7.07%) | 38,066,803 |

| KEL | 5.00 | +0.12 (2.46%) | 33,447,417 |

| WTL | 1.78 | 0.00 (0.00%) | 29,525,333 |

| SSGC | 43.87 | +0.11 (0.25%) | 26,679,632 |

| HASCOL | 12.52 | +1.14 (10.02%) | 26,398,810 |

| TELE | 9.54 | +0.42 (4.61%) | 19,836,175 |

| PSX | 30.43 | +2.05 (7.22%) | 16,136,998 |

| FFL | 17.42 | -0.24 (-1.36%) | 15,314,743 |

| BOP | 10.49 | +0.22 (2.14%) | 14,469,918 |

Top Advancers: Stock Market Performance 14-Jan-2025

Top gainers demonstrated robust performance, led by CJPL and QUICE, both posting impressive double-digit growth. HASCOL continued its upward momentum, reflecting strong interest in energy stocks.

Who are the Top 10 Brokers? Check out for Dec-2024

This rally among top advancers underscores improved market confidence, particularly in smaller scrips showing consistent growth potential. Positive sentiment in financials and manufacturing stocks supported overall market gains.

| Symbol | Price | Change | Volume |

|---|---|---|---|

| CJPL | 6.34 | +0.90 (16.54%) | 2,147,828 |

| QUICE | 7.05 | +0.97 (15.95%) | 12,151,185 |

| ITTEFAQ | 8.71 | +1.00 (12.97%) | 3,284,433 |

| FCIBL | 8.45 | +0.86 (11.33%) | 3,108 |

| PASM | 4.50 | +0.43 (10.57%) | 1,905 |

| GUSM | 10.59 | +1.00 (10.43%) | 114,668 |

| POWERPS | 11.17 | +1.02 (10.05%) | 115 |

| HASCOL | 12.52 | +1.14 (10.02%) | 26,398,810 |

| SPEL | 44.50 | +4.05 (10.01%) | 2,706,861 |

| BFBIO | 210.27 | +19.12 (10.00%) | 1,596,341 |

Top Decliners: Stock Market Performance 14-Jan-2025

Decliners were led by AATM and SKRS, with both stocks witnessing significant sell-offs due to profit-taking and weak sectoral performance.

The broader market gains limited the impact of decliners, though continued weakness in these stocks highlights underlying concerns in specific sectors.

| Symbol | Price | Change | Volume |

|---|---|---|---|

| AATM | 53.15 | -5.90 (-9.99%) | 57,867 |

| SKRS | 11.29 | -1.25 (-9.97%) | 345,276 |

| FPRM | 9.04 | -1.00 (-9.96%) | 326,097 |

| DADX | 69.88 | -7.56 (-9.76%) | 84,181 |

| KPUS | 131.33 | -13.67 (-9.43%) | 11,154 |

| ARPAK | 70.19 | -6.65 (-8.65%) | 18,646 |

| PECO | 600.01 | -56.55 (-8.61%) | 1,873 |

| ANTM | 10.73 | -0.87 (-7.50%) | 1,080 |

| FZCM | 166.13 | -12.87 (-7.19%) | 1,079 |

| FECM | 5.67 | -0.43 (-7.05%) | 8,850 |

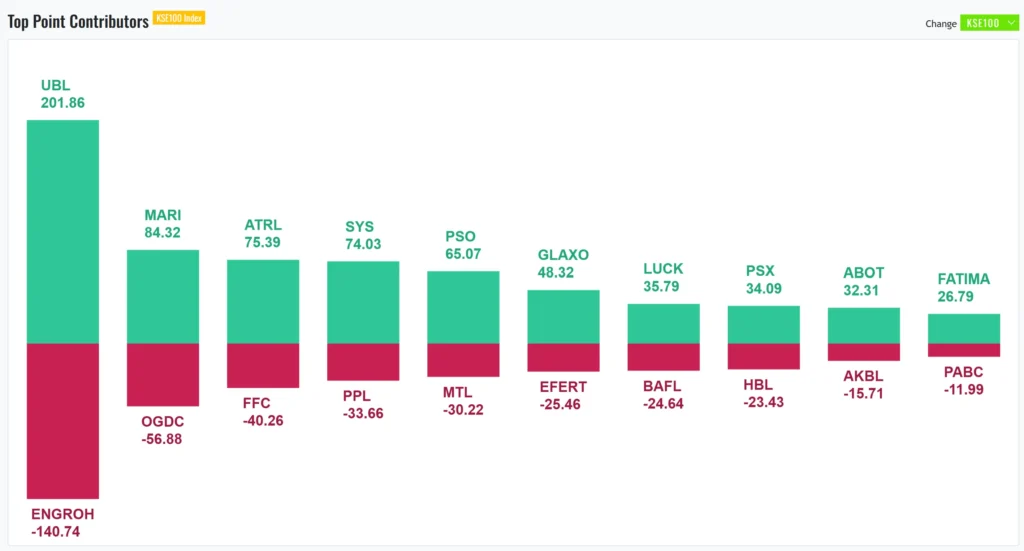

KSE-100 Index Top Point Contributors: 14-Jan-2025

Other Indices Performance Today: 14-Jan-2025

ALLSHR Index

The All Shares Index (ALLSHR) closed positively on January 14, 2025, at 71,438.13, gaining 462.14 points (+0.65%) from the previous session. The index traded within a range of 70,857.52 to 71,552.26, reflecting a steady upward momentum. Trading volumes reached 588.43 million shares, signaling active market participation. While the Year-to-Date (YTD) change remains slightly negative at -1.02%, the 1-Year change recorded an impressive 64.44%, highlighting sustained long-term growth and investor confidence in the broader market.

KSE30 Index

The KSE-30 Index concluded trading on January 14, 2025, at 36,102.27, posting a modest gain of 118.33 points (+0.33%) compared to the previous close of 35,983.94. The index fluctuated within a day range of 35,833.78 to 36,205.34, indicating measured market activity. Total trading volume stood at 129.6 million shares, reflecting steady investor engagement. While the Year-to-Date (YTD) change remains slightly negative at -0.22%, the 1-Year change shows a robust growth of 67.54%, highlighting significant long-term investor confidence in the top-performing companies of the KSE-30.

KMI30 Index

On January 14, 2025, the KMI30 index closed at 177,162.16, showing a modest increase of 601.54 points or 0.34%. The day’s trading saw a high of 177,663.85 and a low of 175,563.73, with a total volume of 179,755,410 shares traded. Over the past year, the index has experienced a notable rise of 62.84%, although its year-to-date (YTD) change stands at a slight decline of -0.83%. The previous close was recorded at 176,560.62. The 52-week range for the KMI30 index spans from a low of 97,029.54 to a high of 187,262.17, indicating significant fluctuation over the past year.

Market Wrap by JS Global: 14 January 2025

Market Wrap by K-Trade: 14-Jan-2025

Comparison with January 13, 2025

The KSE-100 Index continued its rally on January 14, gaining 574.10 points, following a 1,199.71-point increase on January 13. Trading volumes rose to 258.82 million, marking a substantial increase from the previous day’s 196.37 million shares. Key sectors like energy and financials drove the rally, while top decliners remained concentrated in manufacturing and miscellaneous sectors.

Conclusion and Next Day Strategy

The sustained upward trend in the KSE-100 Index reflects improving investor confidence. However, selective profit-taking in certain sectors remains a risk. For January 15, 2025, investors should focus on stocks in energy and financial sectors, while exercising caution with high-risk, overbought scrips.

FAQs: Stock Market Performance 14-Jan-2025

Improved confidence in energy and financial stocks supported market gains.

CJPL and QUICE led the gainers, both posting double-digit growth.

Trading volumes rose to 258.82 million shares.

Market sentiment remains positive, but investors should stay cautious in overbought sectors.

Disclaimer

The information provided in this analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell securities. Investors should conduct their own research or consult with a licensed financial advisor before making any investment decisions. Market conditions are subject to change, and past performance is not indicative of future results.