Stock Market Performance 10-Jan-2025: The Pakistan Stock Exchange (PSX) saw a steady upward trend on January 10, 2025, as the KSE-100 Index gained 609.03 points (+0.54%), closing at 113,247.29. The recovery comes after a streak of volatile sessions, providing a much-needed breather for investors. The market’s range for the day was between 112,013.59 (low) and 113,554.07 (high), reflecting cautious optimism among participants.

While the trading volume was lower at 216.14 million shares compared to the previous day, selective buying in key sectors contributed to the index’s gains. Notable performance was observed in consumer goods and select financial stocks, while the energy sector remained under pressure. Overall, the market sentiment leaned positive, supported by attractive valuations in several stocks.

KSE-100 Index Data

| Metric | Value |

|---|---|

| Closing Value | 113,247.29 |

| Change | +609.03 (0.54%) |

| High | 113,554.07 |

| Low | 112,013.59 |

| Volume | 216,141,298 |

| 1-Year Change | 77.17% |

| YTD Change | -1.63% |

| Previous Close | 112,638.26 |

| Day Range | 112,013.59 – 113,554.07 |

| 52-Week Range | 59,191.86 – 118,735.10 |

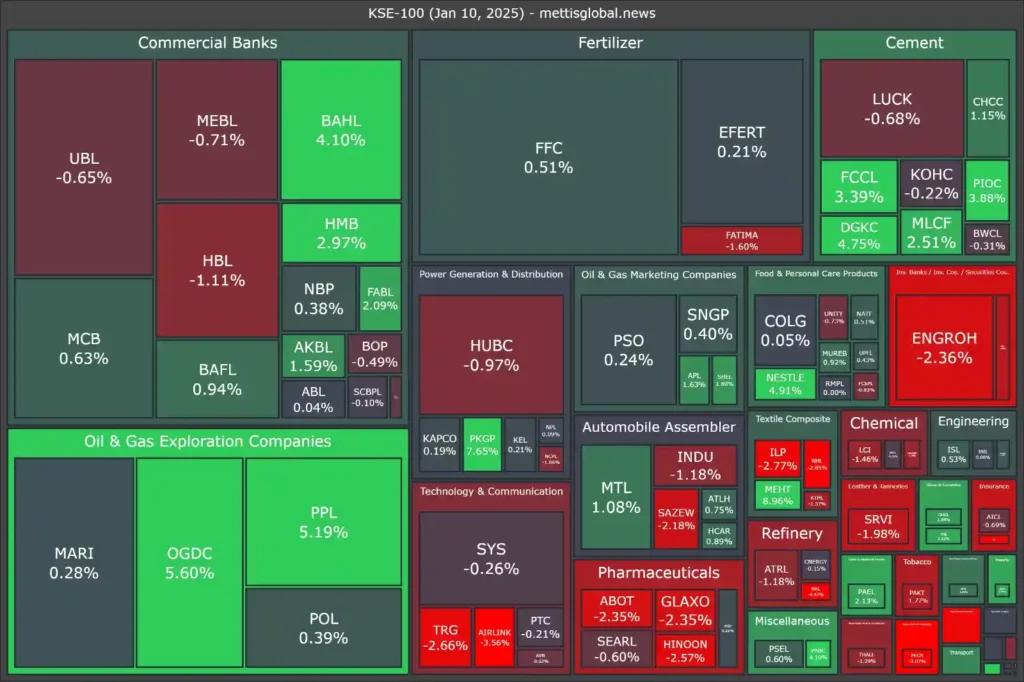

KSE-100 Index Market Map (January 10, 2025)

Top Active Stocks: Stock Market Performance 10-Jan-2025

The active stocks segment witnessed significant participation in high-volume scrips, indicating retail interest. Despite a mixed performance, stocks like WTL and FFL attracted considerable volumes. Investors remained cautious as some active stocks posted minor losses, reflecting selective profit-taking.

Among the top performers, PACE exhibited a notable gain of 5.28%, supported by renewed investor confidence. On the other hand, AIRLINK witnessed a decline of 3.56%, weighed down by weak demand in the technology sector. Despite such fluctuations, the overall activity underscored market participants’ focus on liquidity-driven stocks.

Check out the Next Day Performance: 13-Jan-2025

| SYMBOL | PRICE | CHANGE | VOLUME |

|---|---|---|---|

| WTL | 1.75 | -0.04 (-2.23%) | 68,778,791 |

| FFL | 17.09 | 0.44 (2.64%) | 31,850,296 |

| CNERGY | 6.68 | -0.01 (-0.15%) | 31,582,726 |

| PACE | 7.38 | 0.37 (5.28%) | 23,738,391 |

| KEL | 4.77 | 0.01 (0.21%) | 19,776,001 |

| PAEL | 41.74 | 0.87 (2.13%) | 18,336,226 |

| AIRLINK | 189.64 | -7.01 (-3.56%) | 15,954,539 |

| FCSC | 2.21 | 0.21 (10.50%) | 13,648,509 |

| PRL | 37.34 | -0.93 (-2.43%) | 12,218,101 |

| BOP | 10.09 | -0.05 (-0.49%) | 10,662,317 |

Top Advancers: Stock Market Performance 10-Jan-2025

The day also highlighted significant gains in select stocks. CLCPS topped the advancers list with a 14.71% increase, driven by a strong technical rebound. CHBL and FECM followed closely, posting double-digit gains, fueled by positive sectoral developments.

Stocks such as FCSC gained momentum due to renewed interest in undervalued scrips, while KPUS also closed strong with a 10% increase. The collective performance of these advancers underscores growing confidence in specific sectors, particularly those with solid growth fundamentals.

| SYMBOL | PRICE | CHANGE | VOLUME |

|---|---|---|---|

| CLCPS | 3.90 | 0.50 (14.71%) | 376,062 |

| CHBL | 8.33 | 0.99 (13.49%) | 2,751,780 |

| FECM | 6.06 | 0.70 (13.06%) | 1,468 |

| PKGI | 8.70 | 0.92 (11.83%) | 2,016 |

| FCSC | 2.21 | 0.21 (10.50%) | 13,648,509 |

| DADX | 70.40 | 6.40 (10.00%) | 28,102 |

| KPUS | 137.50 | 12.50 (10.00%) | 1,484 |

| LSEFSL | 15.66 | 1.42 (9.97%) | 29,146 |

| ICCI | 11.47 | 1.04 (9.97%) | 219,438 |

| GEMSPNL | 19.20 | 1.69 (9.65%) | 2,000 |

Top Decliners: Stock Market Performance 10-Jan-2025

The decliners list saw some sharp drops, with DWTM leading the fallers with a 12.72% decline. Weak fundamentals and selling pressure continued to weigh down on the stock. Similarly, FCEL and SGPL posted double-digit losses, highlighting concerns in their respective sectors.

Among others, LIVEN and SHCM also suffered due to sector-specific challenges, reflecting broader apprehensions among investors. The performance of decliners underscores the uneven sentiment across different sectors in the market.

| SYMBOL | PRICE | CHANGE | VOLUME |

|---|---|---|---|

| DWTM | 6.79 | -0.99 (-12.72%) | 1,001 |

| FCEL | 5.52 | -0.67 (-10.82%) | 900 |

| JSMFETF | 13.46 | -1.54 (-10.27%) | 1,371,500 |

| SGPL | 8.51 | -0.96 (-10.14%) | 20,002 |

| LIVEN | 144.61 | -16.07 (-10.00%) | 3,904 |

| AATM | 63.85 | -7.09 (-9.99%) | 20,675 |

| SUHJ | 126.71 | -14.03 (-9.97%) | 50 |

| SHCM | 28.93 | -3.18 (-9.90%) | 1,504 |

| IDRT | 14.06 | -1.54 (-9.87%) | 534 |

| POWERPS | 10.15 | -1.10 (-9.78%) | 602 |

Market Wrap Video by JS Global Capital Limited [10-Jan-2025]

Market Wrap by K-Trade for 10th January, 2025

Comparison with Previous Day

On January 10, 2025, the KSE-100 Index rebounded with a gain of 609.03 points, in stark contrast to the 1,510.19-point decline witnessed on January 9. Trading volumes, however, declined to 216.14 million shares from the previous day’s 268.72 million shares. Key advancers like CLCPS and CHBL contributed significantly to the day’s recovery, while notable decliners like DWTM and FCEL dampened the broader market sentiment.

Conclusion and Strategy for Next Day

The market’s partial recovery signals the potential for further stabilization, particularly in undervalued sectors. However, macroeconomic concerns and sector-specific headwinds continue to pose challenges. For January 11, 2025, cautious optimism should guide investors, with a focus on fundamentally strong and growth-oriented stocks.

FAQs

Selective buying in oversold stocks and positive sentiment in consumer and financial sectors contributed to the recovery.

CLCPS led the gains with a 14.71% increase.

Trading volumes declined to 216.14 million shares from 268.72 million shares on January 9.

The energy sector remained under pressure, as evidenced by declines in stocks like PRL.

The market is expected to maintain a cautious upward trend, with bargain hunting likely to drive selective gains.

Disclaimer

The information provided in this analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell securities. Investors should conduct their own research or consult with a licensed financial advisor before making any investment decisions. Market conditions are subject to change, and past performance is not indicative of future results.